Actuarial Science Major

Program Requirements & Opportunities

- Overview

What is an actuary?

Actuaries construct and interpret mathematical models to evaluate the likelihood of possible future events. They also design ways to reduce the negative consequences of the possible outcomes of these events. A majority of actuaries work in the insurance industry, but actuaries can be found in any industry that requires careful planning for the future, especially in the presence of risk. A more detailed description of what an actuary does can be found here.

How do I become an actuary?

To become an actuary, you need to meet a series of requirements set by the Society of Actuaries or one of the other more specialized actuarial societies. These requirements consist of educational experiences (college courses), a series of tests and some specialized short courses offered by the Society.

Typically, you will meet the educational experience requirements in college and take one or two tests before you graduate. After graduation from college, most prospective actuaries immediately take positions in the industry and continue taking tests while on the job. Most employers pay for these tests and many give paid time off to study for them. There are also graduate programs in actuarial science, but they are not necessary and a majority of actuaries do not follow this route.

Helpful Resources

- The Society of Actuaries

- Be an Actuary is a website focused on introducing the career.

- Actuarial Outpost is a website with many discussion groups, including some that are useful for those studying for tests.

- Courses

Course Requirements

Loading... - Advising

The pre-actuarial advisor at Calvin is Professor Thomas Scofield. If you are interested in studying to be an actuary, you would be well-advised to talk to him early in your Calvin career.

- Careers

Preparation for a career in the actuarial sciences is a collaborative effort involving educational institutions, professional organizations, and companies that employ actuaries. An Actuarial Science major is not required; students who do not major in Actuarial Science typically major in mathematics, statistics, or business and take as many of the courses from the Actuarial Science major as they can.

Some of the required courses for the Actuarial Science major are directly linked to actuarial exams and VEE (Validation by Educational Experience) requirements of Society of Actuaries. These courses would be particularly recommended for students majoring in something other than Actuarial Science.

- STAT-343 Probability and Statistics, especially but also STAT 341 Computational Bayesian Statistics and STAT 344 Mathematical Statistics prepare a student for the first exam, Exam P.

- ECON 343 Research Methods meets the VEE requirement of Applied Statistical Methods.

- ECON 221 Principles of Microeconomics and ECON 222 Principles of Macroeconomics together meet the VEE requirement of Economics.

- BUS 370 Financial Principles, BUS 371 Financial Instruments and Markets and BUS 372 Advanced Corporate Finance together meet the VEE requirement of Corporate Finance.

Internships are another important part of the preparation for a career as an actuary, and several companies advertise paid summer internship opportunities for Calvin students each year. The combination of a passed actuarial exam (or two), an internship, and a strong record in undergraduate coursework are sufficient to apply for most entry level actuarial positions.

After graduation from college, most prospective actuaries immediately take positions in the industry and continue studying for and taking actuarial exams while on the job. Most employers pay for these tests and many give paid time off to study for them. There are also graduate programs in actuarial science, but they are not necessary and a majority of actuaries do not follow this route.

- Sample Course Schedule

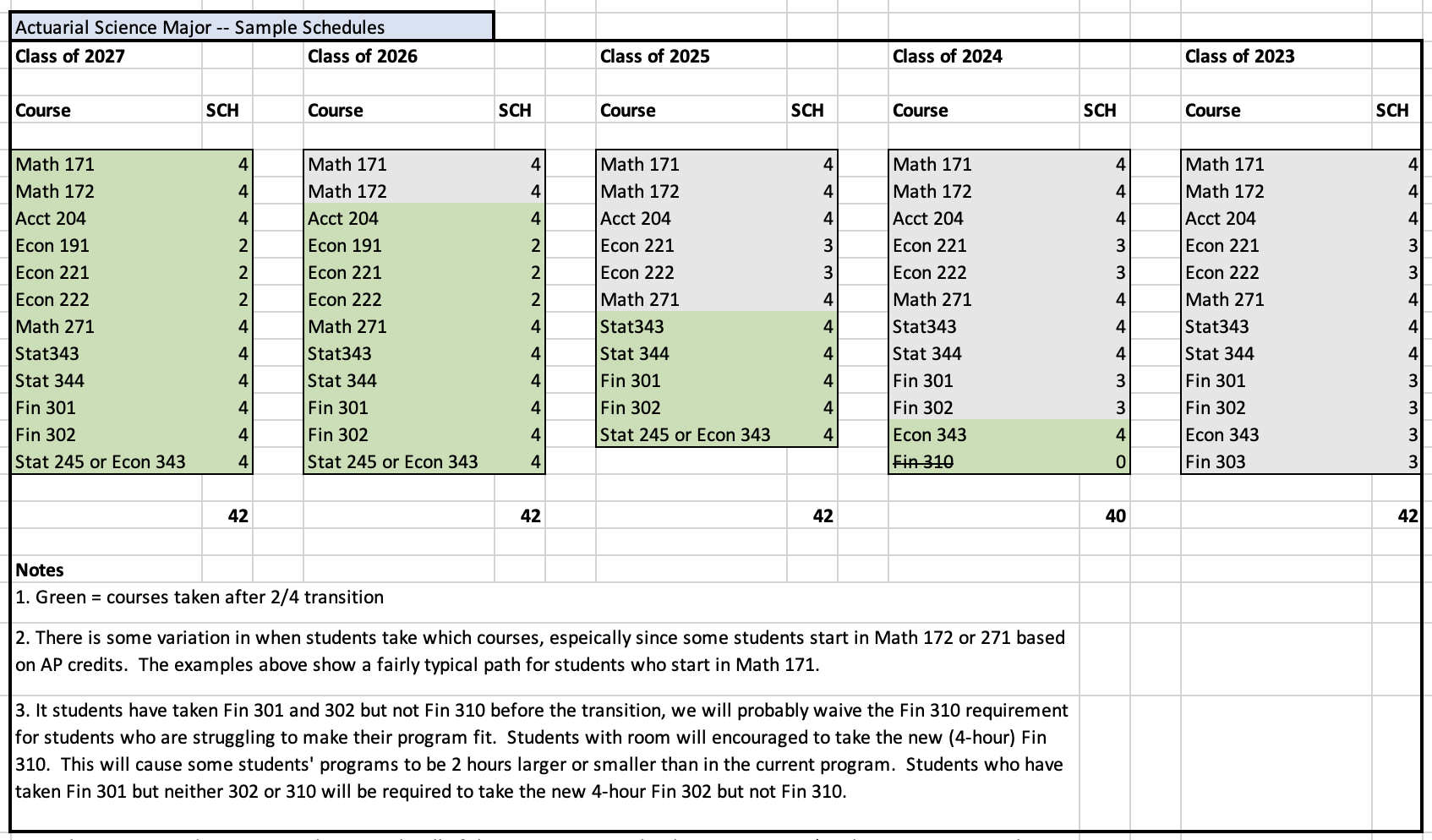

Below is a sample course schedule for the actuarial science major. Click here or on the image below to view a larger version of this image in a new browser tab.

ACADEMIC OPTIONS

With over 100 majors and programs, you’re bound to find something you love.

Browse by category

- Arts

- Business

- Communication & Media Studies

- Education

Undergraduate education

- Birth to Kindergarten

- Pre-Kindergarten to 3rd Grade

- 3rd to 6th Grade

- Art: Pre-K to 12th Grade

- French: Pre-K to 12th Grade

- Health & PE: Pre-K to 12th Grade

- Spanish: Pre-K to 12th Grade

- Special Education Pre-K to 12th Grade

- TESOL: Pre-K to 12th Grade

- Secondary Education

- English: 5th to 9th Grade

- Math: 5th to 9th Grade

- Science: 5th to 9th Grade

- Social Studies: 5th to 9th Grade

- English: 7th to 12th Grade

- Math: 7th to 12th Grade

- Science: 7th to 12th Grade

- Social Studies: 7th to 12th Grade

- Health Sciences

- Exercise Science

- Kinesiology (Pre-professional Emphasis)

- Nursing

- One Health

- Pre-Dentistry

- Pre-Medicine

- Pre-Occupational Therapy

- Pre-Optometry

- Pre-Pharmacy

- Pre-Physical Therapy

- Pre-Physician Assistant

- Pre-Podiatry

- Pre-Veterinary

- Public Health

- Recreation Leadership

- Speech Pathology and Audiology (BA, MA)

- Master of Speech Pathology

- Theraputic Recreation

- Humanities

- Ministry

- Science, Technology, Engineering & Mathematics

- Social Sciences

- World Languages & Cultural Studies

Apply to Calvin

It all starts here! We accept applications on a rolling basis throughout the year. All completed applications receive equal consideration.

Start your journey

Visit Calvin

Find the visit option that works best for you and get a taste for life at Calvin!

Browse Visit Options Launch the virtual tour

Request Info

Learn why Calvin’s dedication to faith and discovery have earned it the rank of #3 among regional Midwest universities.

Costs & Financial Aid

Families from all economic backgrounds—many just like yours—are making Calvin work. Scholarships, grants and loans are the tools that make Calvin possible.

Explore financial aid & Scholarships How much does Calvin cost?