How families just like yours are affording a Calvin education.

Families just like mine? Really?

Really. Take a look:

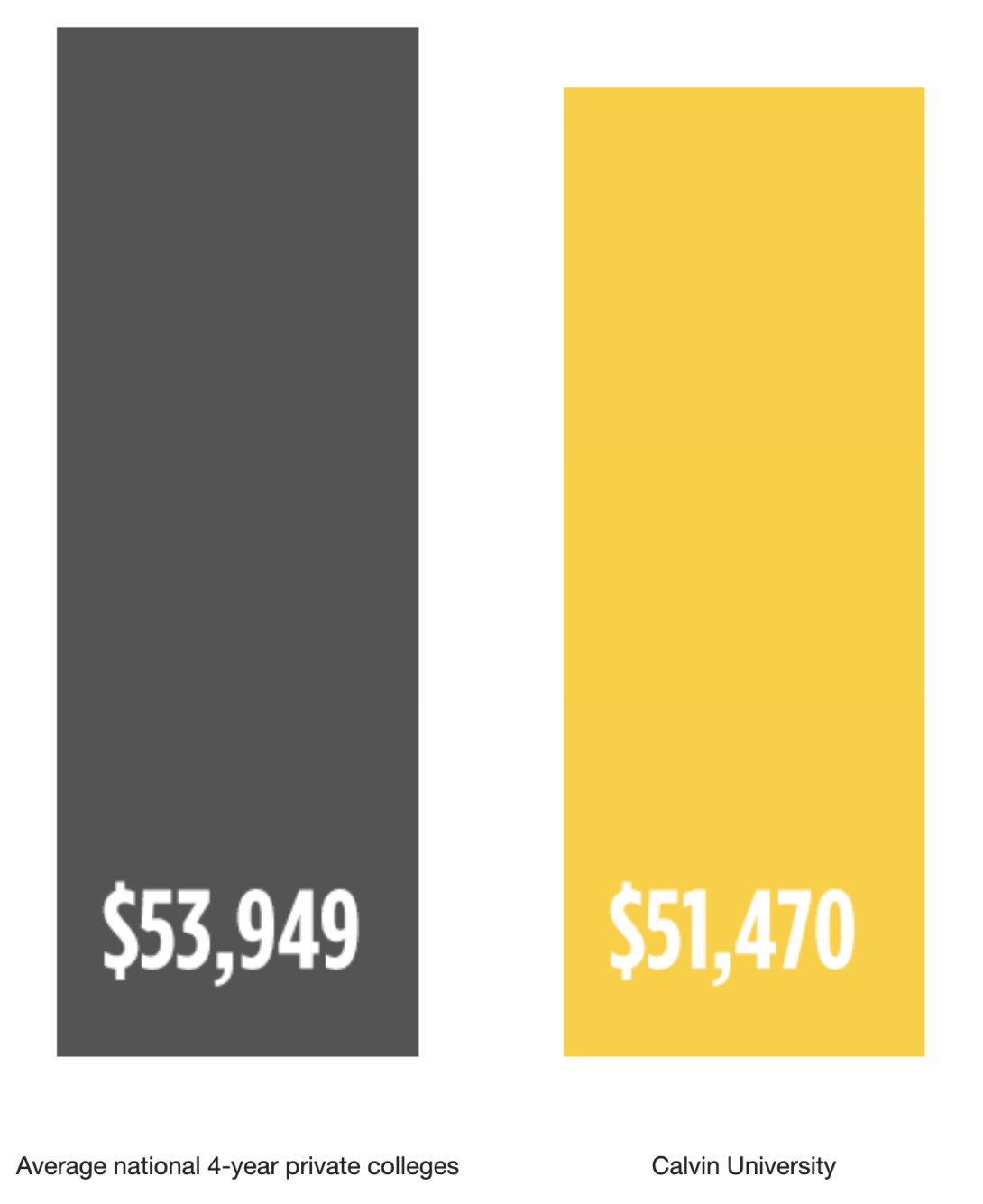

Cutting the Price Tag

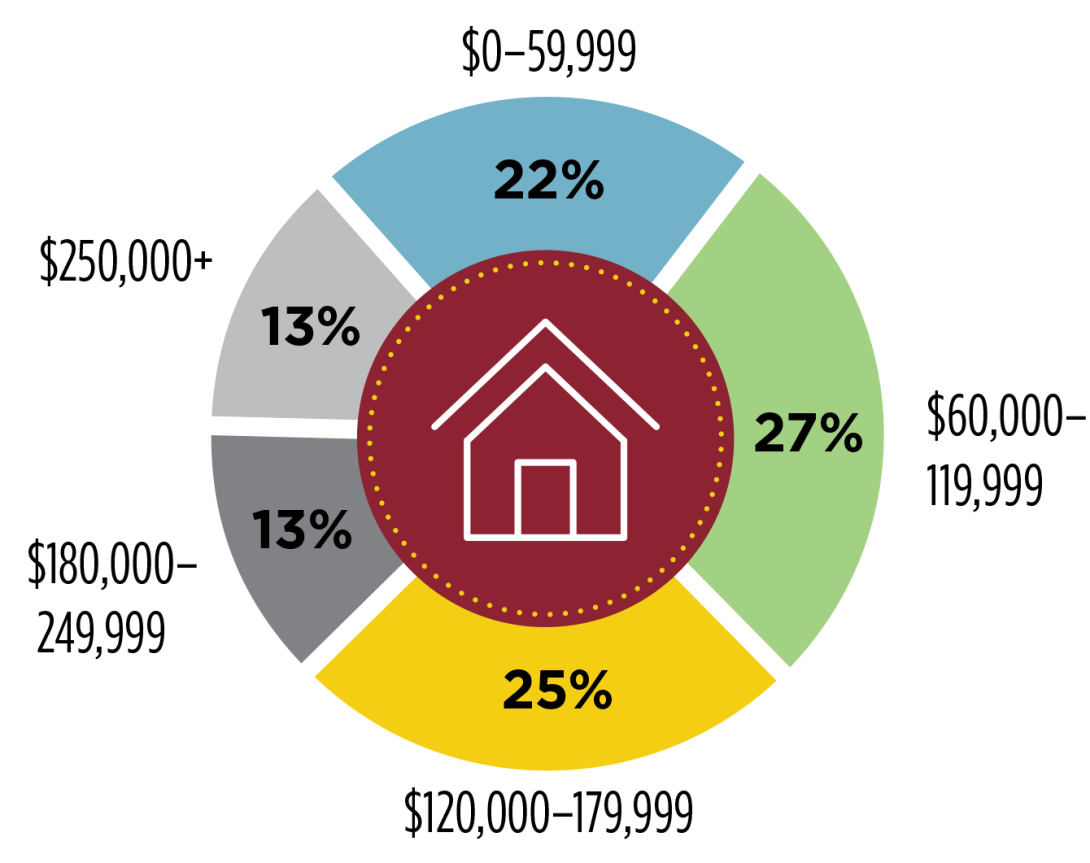

Calvin has undergraduate students from all economic backgrounds.

Family income distribution (2021–2022) for students applying for financial aid.

So how much does Calvin cost?

2025–2026 Total Undergraduate Cost: $52,980

Cost Breakdown

Undergraduate Costs include:

- $40,500 for tuition

- $5,280 for housing

- $7,200 for food

(See Tuition & Costs for details.)

Still, that’s a lot of money—how can my family afford that?

To answer that, let’s first discuss sticker price vs. actual cost.

That $52,980 number?

That’s the sticker price. It’s big and it’s daunting. But for most families at Calvin, it’s not the number they’ll actually pay.

Academic Scholarships

First, we subtract academic scholarships—up to $22,000 based on merit. If you have a 3.0 GPA or higher, you are guaranteed an academic scholarship.

Named Scholarships

Then we subtract Named Scholarships—which average between $2,500–$5,000. We award over 1,400 every year. Admitted Calvin students can apply for Named Scholarships from December 1 to January 31.

Awards & Grants

Next, we see if you’re eligible for other grants and awards that are part of our Knight Promise—like the $2,000 grant for visiting or $2,000 grant for submitting the FAFSA.

Then we subtract need-based grants. Submit a Free Application for Federal Student Aid (FAFSA) to be considered for federal aid (Pell Grants), state of Michigan aid (up to $7,000), or Calvin University’s need-based grants.

Loans

Finally, we subtract student loans—up to $5,500.

Actual Cost

What we’re left with is the actual cost, often times significantly less than the original sticker price. It is the amount left over after scholarships, grants, awards, and student loans have been applied.

That’s still a lot. How will I repay that?

Calvin grads are successful.

on-campus job opportunities.

Undergrad students who have participated in an internship

Calvin grads employed or in grad school

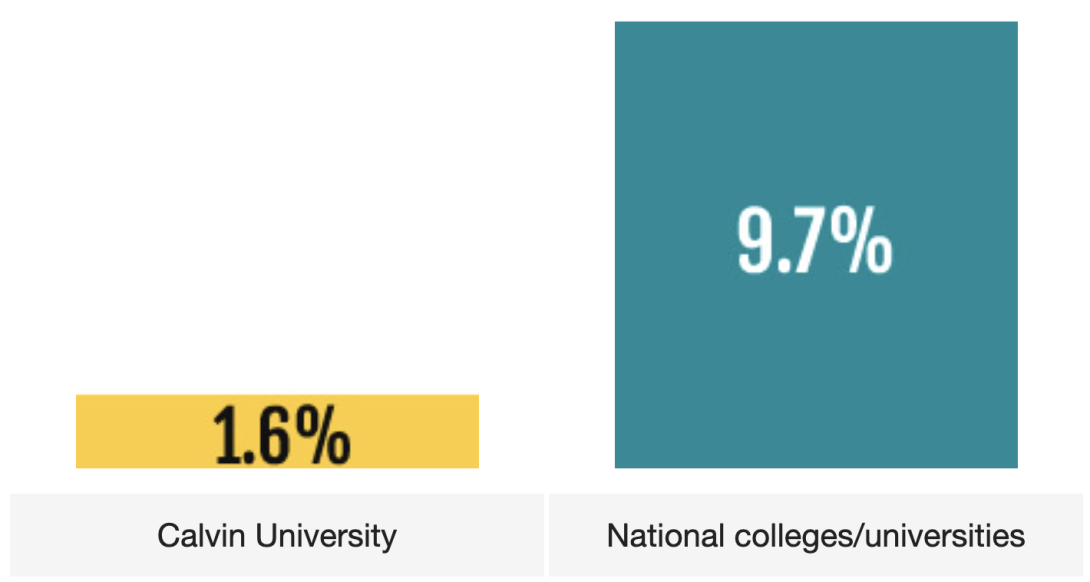

As a result, Calvin grads are able to pay back their loans.

Take a look at these loan default rates among graduates:

What will I get for my investment?

Don't Just Take Our Word For It

U.S. News & World Report

Calvin University is ranked #4 overall, #1 in best undergraduate teaching, #2 most innovative school, and #16 "Best Value Schools" in the Midwest Regional Universities category.

The Princeton Review

Professors are “extremely talented, interesting, and connected in their specific fields.” Instructors are also “masters at integration of education and Christianity,” making the classes at Calvin less about teaching the requisites for getting a job and “more about how to continue to learn about the field and how Christianity should figure into it.”

Money Magazine

Calvin is included in “The Best Colleges For Your Money,” a list compiled based on educational quality, affordability, and career outcomes.